The Case for a Revision of Your Pension Plans

We all remember the 90’s, right? Well, here’s a reminder as the topic applies here.

The period 1980 – 2000 was, to me, “The Roaring Twenty.” The stock markets climbed at a cumulative rate of return (CROR*) of just under 14%. To put that in perspective, the CROR for the period 1928 – 1980 was under 4%. Ah, great times.

People quickly grew used to that financial environment, with that growth. In the 80’s the rapid climb was questioned but the continuation into the 90’s became increasingly “normal.” An important part of our financial history is that in those times, notably during the 90’s, employees wanted to participate in that growth, and, for many, that meant boosting the pension plans they were associated with. It was common to hear of employee groups negotiating pension plan “promises” with management, asking for 7, 8, 9% fund growth rates.

Imagine yourself as management of a large enterprise (corporate, municipal, whatever…) tasked with negotiating a settlement with the employees and wondering if an increase is realistic. You might turn to your financial consultant and ask, “can we really increase and bring the promised growth rate to 7 or 8%?” The answer was commonly “yes, the markets have been strong for years and 7% looks easy!” Agreements were reached and everything looked solid.

Enter the turbulent 2000’s. The “tech bubble” burst in 2000, the markets suffered enormously in 2007-2009, and throughout there was tremendous market volatility.

It seems that people (many financial professionals as well as the layman) don’t quite see volatility for what it is…an enormous erosion factor fighting cash and wealth growth. The use of “average returns” as a selling point is misleading, even destructive. We can look at a simple example to gain some insight.

Back to you as management. You promised your employees a 7% increase in the pension fund accumulations back in the 90’s. You made your investments and then 2000 came. Let’s simplify the game this way:

1) You have no retirees yet, so you are mostly accumulating for the future pension payouts.

2) You have little to no expenses so far, as we keep it simple.

3) You are gauging the success of your efforts by comparing to the S&P index.

That, however, raises a question: did you assume that the S&P would go straight up? It seems many in management did. If you did make that assumption, did you use “average return…” as the core of your assumptions?

“Average returns” is a meaningless metric, and you can gain some insight here:

https://82financial.com/blog/2020/5/13

Still imagining, let’s look at the situation you are likely in: You are tasked with growing your pension plan at a minimum of 7%, compounding, and then maintaining that growth as you start depleting that fund through pension payouts, right? If you find that your specific investments have done well and better than the S&P index, that seems good but wait…

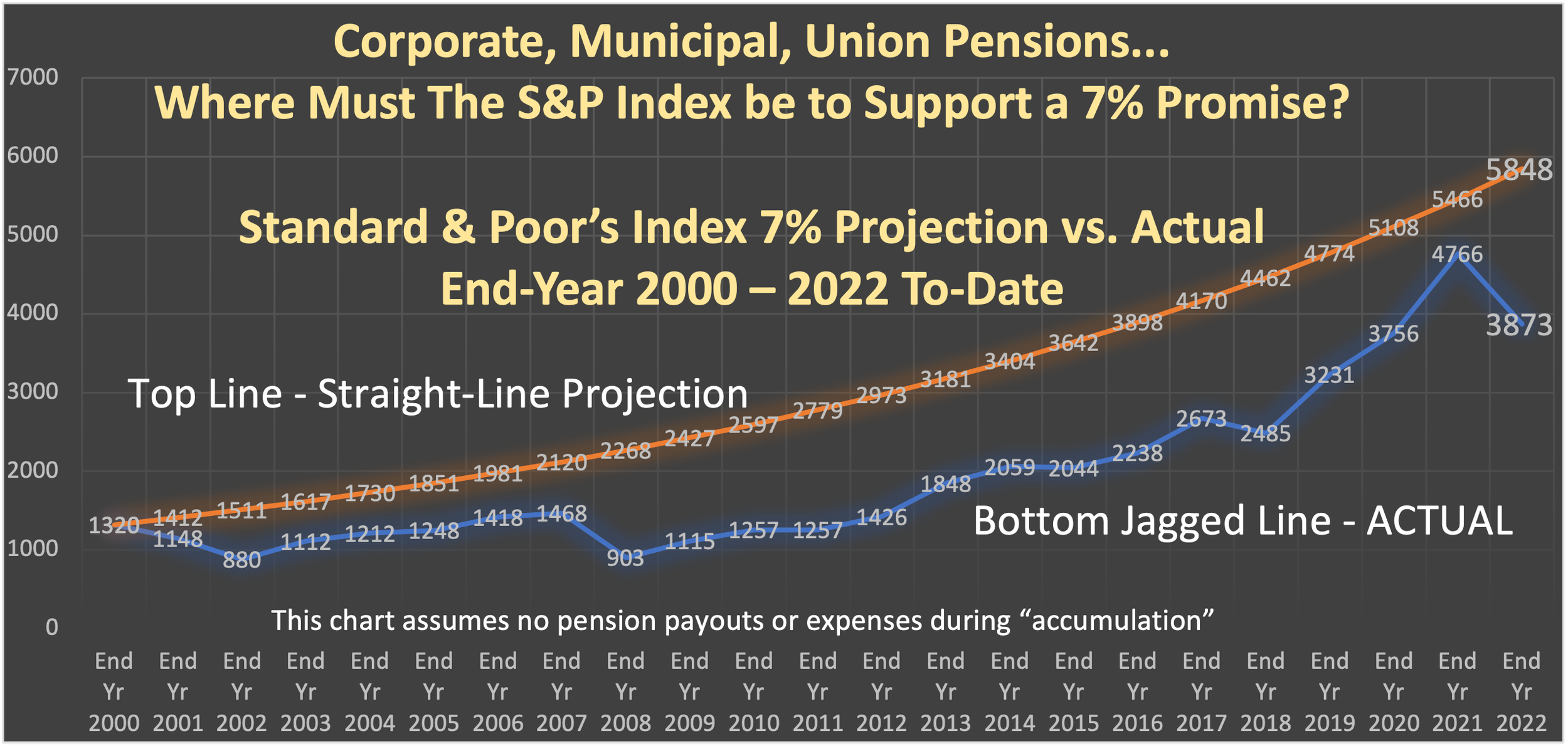

Has the S&P index grown at 7% every year since you agreed to your 7% pension plan contract? Here’s a visual of the S&P’s actual growth and where it would have to be (via a “straight-line projection”) if it were to support the 7% promise:

Looks like the S&P didn’t hold up its end of the bargain, right? As of end-2022, for that 7% support, the S&P index should be at 5848, but it’s only at 3873. The S&P would have to climb over 50% (instantaneously) to get where it needs to be, at minimum.

It should become clear as to why pension funds across the country are behind on accumulations to satisfy promises.

Now let’s view this on a personal level…that is, let’s compare your personal retirement plan. Will you be one of the pensioners? Will the pension fund last as long as you? How do 401(k)’s and IRAs differ from a large pension? Well, specific investments notwithstanding, the reliance on the markets is similar. Volatility is not helpful. Is it any wonder so many retirement savers are behind on their cash growth targets?

If you are planning to be reliant on your 401(k) or IRA, consider the results to-date. Mutual funds are not consistent and are “micro-diversified”** which I consider a negative. An approach which is focused on consistency is key.

Yes, I recommend Whole Life insurance. A “participating, non-direct recognition policy” from a mutual insurance company which would allow you to participate in the distribution of profits as an owner of the company.

Why haven’t you heard about this approach before? Well, I don’t know. It’s been going on for over 150 years…

*The Cumulative Rate of Return is the interest rate that, growing consistently with compounding, takes you from point A to point B.

Example:

Standard & Poor’s Index (S&P) at end-of-year 2000 was 1320.

S&P Index at end-of-year 2022 closed at 3873.

Point A (1320) to point B (3873) climbed at a smooth, compounded rate of 5.01.

Why is that important? If we calculate the “average return” from the S&P actual numbers above, we arrive at 6.6%. Again, 6.6% average return. That result is closer to the 7% projection on the chart than to the CROR of 5.01%. The average investor (and many professionals) will look at the 6.6% (or 7%) and see that as reality. It’s reality only as far as the verbiage used to express it. IT IS NOT REAL for the investor looking to the ability to use the expected dollar results to pay bills.

The 5.01% CROR here is reality. “If I start with an investment (exactly mirroring the S&P Index) at the end of the year 2000, and get to the end of the year 2022, what growth will I really see? I will get 5.01%, regardless of the ups and downs. “Point A to point B.” That’s all I care about, right? What will I have at the end? That’s it!”

What is the 6.6% average return? It is the average of the changes in the end-of-year values, expressed as a percentage each year. IT IS THE AVERAGE CHANGE. IT IS NOT THE AVERAGE RETURN.

VOLATILITY is the culprit that erodes results.

Learn more here: https://82financial.com/blog/2020/5/13/

**Micro-diversified: “Diversification” is a way to prevent or minimize losses, not (in and of itself) a way to create wealth. A topic for another day.